How will the new U.S. President’s climate actions impact real estate?

Regulations from the Biden administration could affect commercial real estate more than any in modern history

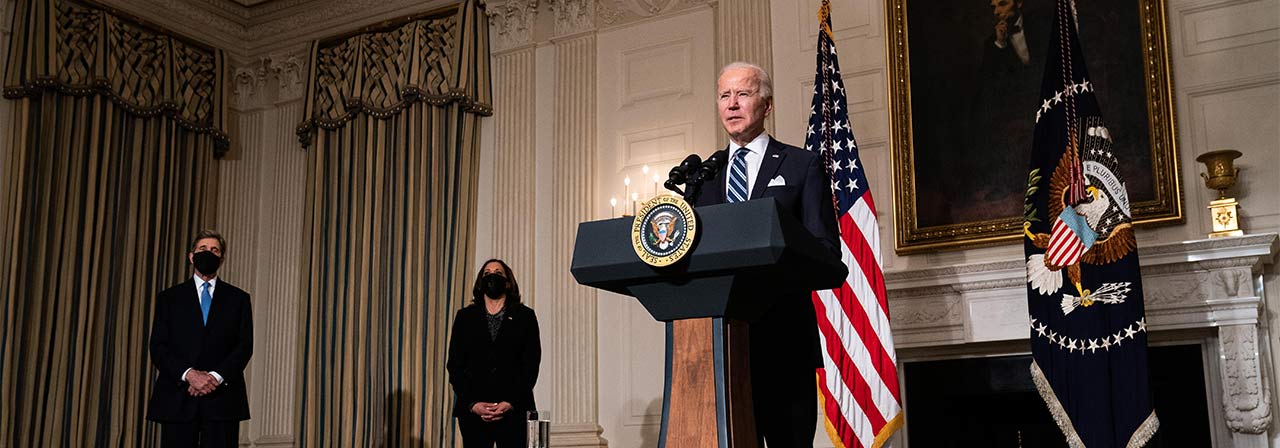

While it’s just the beginning of the new U.S. presidency, Joe Biden has already taken a markedly different stance on climate change from his predecessor — and these changes could have real estate implications down the line.

Within hours of his inauguration, Biden took executive action to rejoin the Paris Agreement. He signed an executive order revoking the permit for the Keystone XL oil pipeline and directed federal agencies to “immediately review and take appropriate action to address” more than 100 policies or regulations set forth during Donald Trump’s presidency that Biden argued were damaging to either the environment or public health. He also established a task force to assemble a governmentwide action plan for reducing greenhouse gas emissions and issued a memorandum making climate change a national security priority, among other measures that send a clear signal that the environment is front and center on his agenda.

These actions do not bring about any immediate ramifications for commercial real estate but they do signal a sea change that is likely to bring regulatory changes to the industry. Real estate accounts for 40 percent of the world’s energy consumption, so it’s not a stretch to imagine that energy efficiency standards for buildings, for example, could become more stringent. This could include regulations that impact both the companies that occupy office space and the building owners they lease from.

“Biden is sending a signal to the global community and to fellow Americans that the U.S is once again going to get serious about climate action,” says Jennifer Hill, Global Product Owner, Sustainability Integration, JLL. “Right now, when it comes to real estate, these orders are more about planting a flag than having immediate fiscal and regulatory impact, but these flags could foretell the administration’s executive priorities and commitment to seeking legislative action.”

It could very well be the first regulatory push that would most significantly impact the commercial real estate industry in modern history, Hill says. While Banking regulations, such as those that were instated after the 2008 financial crisis, impacted global capital flows funding CRE, the finance services sector felt the most significant impact. Past policies around engines and emissions have targeted industrial sectors primarily, as those industries were the most visible contributors to emissions at that time.

“It’s likely that there are incoming regulations that could impact the built environment above all else,” she says., noting that the International Energy Agency estimates that the built environment accounts for approximately 36 percent of global final energy consumption and nearly 40 percent of total direct and indirect CO2 emissions.

What is the investor impact?

Exactly how commercial real estate will be impacted is not yet clear, Hill says, cautioning against assumptions that any future regulations would be good or bad for the industry. If legislation includes incentives for both companies and landlords greening their buildings, for example, it could be a boost to the industry.

“A huge question when eyeing future legislation is how regulations are balanced with incentives,” Hill says. “What are the sticks? And what are the carrots being offered? Strong incentives could be a good thing for real estate if they induce investment, resulting in increased asset values. But requiring upgrades without incentivization could slow growth in the industry, especially if property owners and occupiers who have shut down their offices during the pandemic need to make a lot of expensive changes at the same time they are making decisions about re-opening buildings and workplaces and rationalizing their real estate portfolios.”

A giant question for investors is how climate-related regulations fit in the context of what the Biden administration’s budgetary guidelines end up being, most specifically, around infrastructure.

Another consideration is the shift to investor focus on real assets, considering their real estate and infrastructure investments collectively, Hill says.

Looking for more insights? Never miss an update.

The latest news, insights and opportunities from global commercial real estate markets straight to your inbox.

“If there is even a moderate government growth plan around infrastructure, that sector will present a sound investment that investors may choose over assets that need to be retrofitted to meet climate-related regulations, especially if those are not incentivized as well,” she says. “How the Biden administration converts signals into legislation and agency priorities could present an inflection point in the real estate industry’s role in the climate crisis – from a contributor to climate risk to a catalyst for meaningful, sustainable change.”

There is also a possible scenario in which regulations boost both infrastructure and real estate assets as a whole.

“JLL is optimistic about the renewed focus from the Biden administration on both infrastructure upgrades and sustainable energy alternatives that are currently proposed for funding in 2021,” says Kevin Wayer, CEO, JLL Public Sector and Higher Education. “I predict that many of our public and private sector clients will be well positioned to benefit from these initiatives, which also serve to create a better world.”

Some companies say, “aren’t we already doing this?”

The corporate race to net zero was already heated during the previous administration, with companies making environmental commitments that are needed not just to save the planet but to attract and retain talented people from younger generations who “care much more deeply about the environment as well as working for a company that shares their values,” says Robbie Hobbs, Global Product Group Lead for Workplace Management at JLL, which includes energy and sustainability products globally. Biden’s actions have the potential to accelerate this push.

“My opinion is that clients didn't lose momentum despite the actions from the previous administration and were actually doubling down,” Hobbs says, noting that last year, despite COVID-19, the thousandth company pledged to meet science-based targets that would mitigate climate change and the number of companies making net zero carbon pledges more than doubled over 2019 levels.

“Donald Trump’s policies did not dent the momentum of the private sector,” he says. “The Biden administration’s reversal of that just helps the momentum and could provide additional financial incentives that were already evident to many in the C-suite.”

For building owners, a healthy building that is sustainable is essential to keeping and attracting tenants that have made these promises.

“Tenants that have made carbon-zero commitments are assessing the buildings they occupy based on their emissions,” he says.

How to prepare

While a lot is unclear, there are still things companies and owners can do to prepare for the current administration’s environmental agenda, says Jennifer Fortenberry, Global Energy Product Manager, JLL.

The U.S. Chamber of Commerce recently embraced the potential for market-based solutions, such as carbon taxes, to reduce greenhouse-gas emissions, joining several major business groups that in recent months have said Congress needs to act.

“Carbon accounting and reduction plans will be more important than ever in preparation for this and in support of growing corporate commitments,” she says. “If you don’t know your carbon footprint, now is the time for measuring your impact, and also learning the impact of climate change on your business, both of which are grounded firmly in data management and analysis.”

Contact Jennifer Hill

What’s your investment ambition?

Uncover opportunities and capital sources all over the world and discover how we can help you achieve your investment goals.